When it comes to protecting your investment in your vehicle, there are several insurance options available. One type of coverage that you may have heard of is Gap Insurance. But what exactly is Gap Insurance for cars, and is it something that you need to consider adding to your insurance policy? In this blog post, we will explore the ins and outs of Gap Insurance, how it works, who needs it, and where you can purchase it.

Understanding the Basics of Gap Insurance

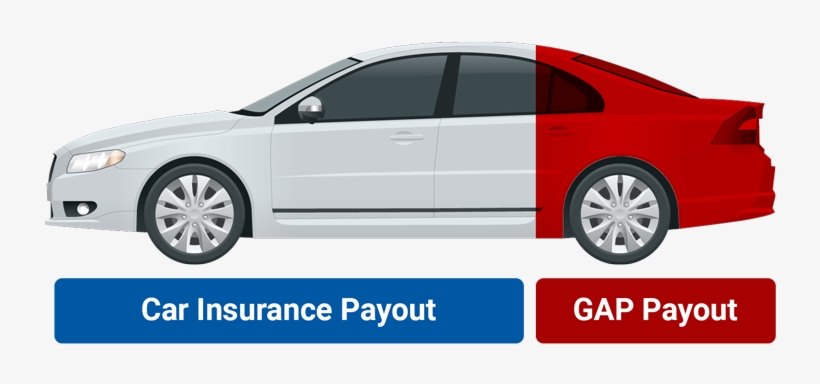

Gap Insurance stands for Guaranteed Asset Protection Insurance. This form of coverage plays a critical role for vehicle owners by safeguarding against financial losses that occur when compensation from a standard auto insurance policy falls short of the amount still owed on the vehicle’s loan or lease. Essentially, it covers the “gap” between the vehicle’s appraised market value, as determined by your primary insurance, and the remaining balance on your loan or lease.

- This type of insurance is particularly significant in situations where depreciation outpaces the loan payoff schedule. Given the rapid rate at which new cars depreciate – often losing a significant portion of their value in the first year alone – owners can find themselves in a financial bind if their vehicle is totaled or stolen early in the ownership period. Standard auto insurance policies only cover up to the current market value of the vehicle, not the total amount you may owe the lender, which is where Gap Insurance becomes invaluable.

- By offering financial protection in these situations, Gap Insurance ensures that you are not left paying out of pocket for a vehicle you no longer have. It provides an essential safety net, particularly for those who finance the majority of their vehicle’s purchase price or select longer-term loans, which can increase the duration and likelihood of being in a negative equity situation.

How Does Gap Insurance Work?

Imagine you’ve just driven off the lot with a new vehicle that you financed for $30,000. Despite its initial value, vehicles depreciate quickly, and a few months down the line, your car might be valued at $25,000 by your insurance company after an accident. However, the loan amount you have yet to pay off is $28,000. This scenario leaves you with a $3,000 shortfall—the “gap” between the insurance payout based on the current market value and the outstanding loan balance. This is precisely where Gap Insurance steps in to cover the difference.

- It activates when the payout from your comprehensive or collision insurance does not fully cover the remaining balance owed on your financed vehicle. Without Gap Insurance, you would be responsible for covering this difference out of pocket, a situation that can put a significant financial strain on many.

- It’s a safeguard to ensure that in the event of a total loss, you won’t be burdened with the remaining loan amount for a vehicle you can no longer use. By paying for the “gap,” this insurance helps you to mitigate the potentially steep costs associated with car depreciation, especially in the early years of ownership when the discrepancy between the vehicle’s value and the loan balance tends to be greatest.

The Crucial Difference Between Gap Insurance and Standard Auto Insurance

Understanding the key distinctions between Gap Insurance and standard auto insurance is vital for vehicle owners to navigate their coverage needs effectively. Standard auto insurance policies are primarily designed to offer compensation for physical damage to your car and liability in case of accidents, including property damage and injuries to others. This includes comprehensive and collision coverages, which respectively handle non-collision related incidents and damages from collisions.

- In contrast, Gap Insurance specifically targets the financial discrepancy that can arise when the actual cash value (ACV) of your vehicle, as determined by your standard auto policy in the event of a total loss, is less than the amount you still owe on a loan or lease. It’s a specialized form of protection that steps in to cover this “gap,” ensuring that you’re not financially responsible for the difference.

- This coverage is supplemental and does not include the benefits provided by standard auto insurance, such as coverage for vehicle repairs or medical expenses after an accident. It is designed to work alongside your existing auto insurance policy to provide an additional layer of financial security. Choosing Gap Insurance involves evaluating your financial exposure in the event of a total loss and considering the depreciation rate of your vehicle against your loan terms. It is an essential consideration for those with significant amounts outstanding on their vehicle financing, beyond what standard insurance alone can cover.

Who Really Needs Gap Insurance?

Determining who should consider Gap Insurance involves assessing one’s specific circumstances around vehicle ownership and financing. Individuals who may find this type of insurance especially beneficial include those who put down a small initial payment on their vehicle. This is because a smaller down payment often leads to a larger balance that can quickly surpass the vehicle’s depreciating market value. Additionally, those who opt for extended loan periods, such as 60 months or more, might also be at higher risk of facing a gap between the loan balance and the car’s value due to slower loan payoff rates.

- Owners of vehicles known for rapid depreciation shortly after purchase are prime candidates for Gap Insurance. This rapid loss in value can exacerbate the potential for a financial gap in the event of a total loss. Furthermore, individuals whose financial situation would make it challenging to cover the difference between their insurance. Payout and the remaining balance of their vehicle loan in case of an accident or theft should seriously consider Gap Insurance.

- It acts as a financial safety net, preventing them from being burdened by payments for a car they can no longer use. By evaluating these factors, car owners can make informed decisions about whether Gap Insurance is a prudent addition to their auto insurance portfolio.

How to Determine If You Need Gap Insurance

Evaluating the necessity of Gap Insurance requires a careful examination of your vehicle financing and ownership circumstances. Begin by reflecting on the size of your down payment; a smaller down payment often leads to a larger outstanding loan balance, heightening the risk of a gap between the loan amount and the car’s depreciating value. Additionally, the term length of your loan is a crucial factor; longer loan terms, extending 60 months or more, slow the pace of loan repayment, which can amplify the financial gap risk due to the vehicle’s depreciation rate.

- Consider how quickly your car loses value. Certain models are notorious for rapid depreciation, which can drastically widen the financial gap in the event of total loss or theft. Your personal financial resilience also plays a significant role. If absorbing the potential loss between your vehicle’s market value and the remaining loan balance would place undue strain on your finances, Gap Insurance may be a prudent safeguard.

- Reflecting on these considerations will help you gauge the potential benefits Gap Insurance could offer in your unique situation. It’s about assessing the intersection of your financial landscape with the inherent risks of vehicle depreciation and loan terms, without necessarily revisiting the broader basics of what Gap Insurance entails or its function as a supplemental coverage to standard auto insurance policies.

Where to Purchase Gap Insurance

Gap Insurance is available from several sources, each offering different advantages depending on your needs and circumstances. Many car owners opt to secure Gap Insurance through their current auto insurance company. Adding it to an existing policy can simplify your insurance management, keeping all your vehicle coverage under one roof. Additionally, some auto insurers may offer the convenience of bundling Gap Insurance with your standard auto policy at a discounted rate.

- Alternatively, car dealerships often provide Gap Insurance at the point of purchase. This option can be particularly appealing for those who prefer to wrap all vehicle-related expenses into one package. However, it’s important to note that while convenient, dealership-sourced. Gap Insurance might come at a higher cost compared to other options.

- For those seeking the most competitive rates, standalone Gap Insurance providers specialize in this coverage and may offer the most affordable premiums. Exploring offerings from these providers allows you to compare quotes and terms directly, potentially saving money over time.

- When deciding where to purchase Gap Insurance, it’s beneficial to explore all three avenues. By obtaining quotes and understanding the terms from each source. You position yourself to make an informed choice that aligns with your financial situation and coverage needs.

Understanding the Costs of Gap Insurance

The expense associated with Gap Insurance varies based on factors such as the insurance company you choose. The initial value of your vehicle, and the duration of your loan or lease agreement. Generally, it’s regarded as a reasonably priced addition to your insurance portfolio. With annual premiums that can range between $20 to $100. This variation in cost highlights the importance of shopping around and comparing offers from different providers.

- When evaluating the cost of Gap Insurance, it’s crucial to weigh the premium against. The potential financial risk of not having the coverage in the event of a total loss. Although it represents an additional expense on top of your existing auto insurance policy. The protection it offers against significant financial shortfall can make.

- It a wise investment, especially for those with new or expensive vehicles, long-term loans, or minimal down payments. It’s also worth noting that some insurers may allow you to pay the Gap Insurance premium upfront or integrate. It into your monthly auto insurance payments, offering flexibility in how you manage the cost.

Filing a Claim with Gap Insurance: What You Need to Know

Navigating the process of filing a claim with Gap Insurance necessitates. A meticulous approach to ensure that all your bases are covered. First and foremost, promptly notify your provider of the incident. That led to the total loss or theft of your vehicle. Timeliness in communication is crucial to expedite the claims process. As part of your claim submission, compile a comprehensive dossier including the accident report. The declaration page from your primary auto insurance policy, and the official notification of the primary insurance claim’s settlement.

- Also essential is the inclusion of your loan or lease agreement, highlighting the current balance at the time of loss. This documentation will serve as the foundation for your claim, facilitating. The assessment of the coverage amount you’re entitled to receive.

- Keep a detailed record of all correspondences with your insurance providers throughout the claims process. This includes saving copies of emails, notes from phone conversations, and any other communications. These records can be invaluable in clarifying any misunderstandings and ensuring that your claim is processed correctly and efficiently.

- Finally, be proactive in following up on your claim status. Regular communication with your provider will help keep the process. Moving forward and allow you to address any potential issues promptly. Adhering to these steps will significantly streamline the claims process, aiding in a smoother resolution to your claim.

Conclusion

Gap Insurance emerges as a critical safeguard for those facing the predicament of a vehicle’s. Value plummeting below the outstanding loan amount due to depreciation or theft. This specialized insurance form addresses a niche yet potentially devastating financial scenario. Providing a layer of security beyond what standard auto insurance offers. Deciding to invest in should be based on a comprehensive evaluation of your vehicle financing specifics. Including down payment size, loan term, and the depreciation trajectory of your car model. While not mandatory for every car owner, for those in vulnerable. Financing situations, it represents a strategic move to protect against unforeseen financial losses. In sum, considering Gap Insurance is a prudent step for those looking to shield themselves from the economic repercussions tied. To the early years of vehicle ownership and loan repayment, ensuring financial resilience in the face of adversity.